Get the free of 1164 fillable form

Show details

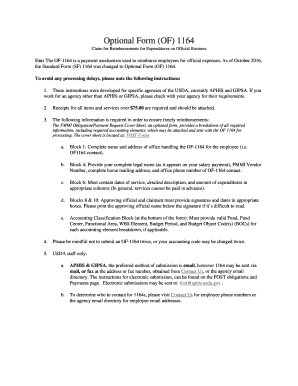

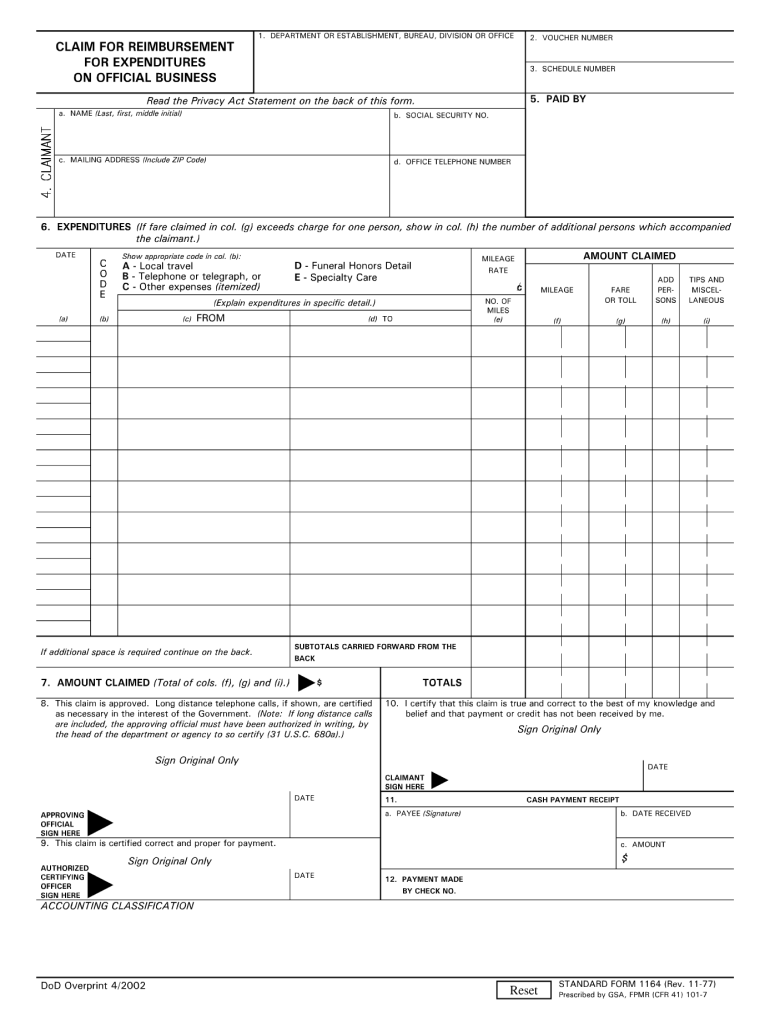

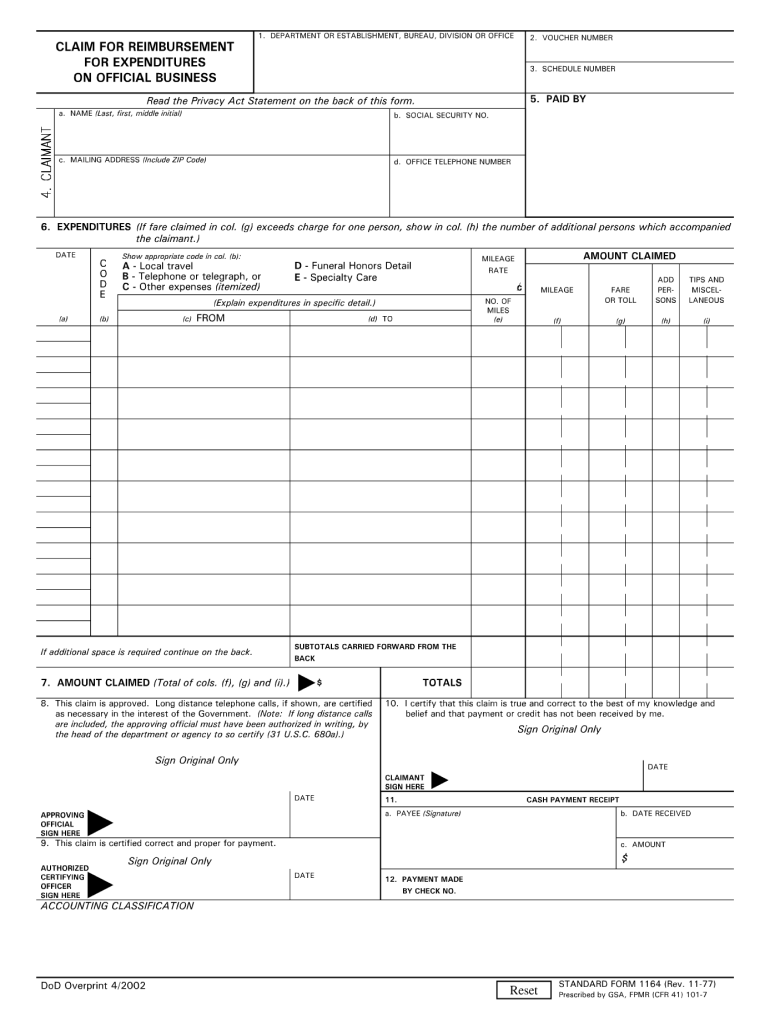

CLAIM FOR REIMBURSEMENT FOR EXPENDITURES ON OFFICIAL BUSINESS a. NAME (Last, first, middle initial) 1. DEPARTMENT OR ESTABLISHMENT, BUREAU, DIVISION OR OFFICE 2. VOUCHER NUMBER 3. SCHEDULE NUMBER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your of 1164 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of 1164 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing of 1164 fillable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit of1164 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out of 1164 form

How to fill out sf 1164:

01

Start by gathering all necessary information such as your name, address, and phone number.

02

Fill out the first section of sf 1164, which includes personal information such as your social security number and date of birth.

03

Move on to the second section, where you will provide details about your employment history and any previous federal service.

04

In the third section, you will need to provide information about any previous injuries or illnesses that are relevant to your current claim.

05

Fill out the fourth section, which is dedicated to details about the current injury or illness for which you are filing the claim.

06

In the fifth section, provide information about any medical treatment or examinations you have received related to the current injury or illness.

07

Proceed to the sixth section, where you will provide details about any compensation or benefits you have already received for the current injury or illness.

08

Finally, sign and date the form, and make sure to include any additional supporting documentation if required.

Who needs sf 1164:

01

Federal employees who have suffered a work-related injury or illness.

02

Individuals who are filing a claim for compensation or benefits related to a federal workplace injury or illness.

03

Anyone who requires documentation or proof of a work-related injury or illness for legal or medical purposes.

Fill sf 1164 form reimbursement : Try Risk Free

People Also Ask about of 1164 fillable

What is optional form 1164?

What are the different types of reimbursement?

What is an example of a reimbursement?

What is reimbursement form?

What is an example of a reimbursement?

What is sf1164?

What is an optional form 1164?

What are the different types of reimbursement?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sf 1164?

SF 1164 refers to a form titled "Claim for Reimbursement for Expenditures on Official Business". It is a standard form used by federal employees to request reimbursement for authorized travel expenses, transportation costs, or other official business-related expenditures. The form typically requires the employee to provide details about the expenses, including dates, amounts, and justifications for the reimbursement request. SF 1164 is often submitted to the appropriate department or agency for review and approval.

Who is required to file sf 1164?

The SF 1164 form, also known as the Claim for Reimbursement for Expenditures on Official Business, is typically required to be filed by federal employees or authorized individuals who need to seek reimbursement for official expenses incurred during travel or other official duties.

How to fill out sf 1164?

To fill out SF 1164, follow these steps:

1. Begin by downloading and opening SF 1164 from the official U.S. government website or obtaining a physical copy from the appropriate office.

2. Start by filling in the "Claimant Contact Information" section. This includes the full name, address, email address, and phone number of the person submitting the form.

3. Next, provide the "Payee Information." This section should include the name of the payee, their address, and their taxpayer identification number.

4. In the "Claim Number" field, enter the appropriate number related to the claim or case being filed for.

5. Fill in the "Amount of Claim" box with the specific dollar amount being claimed. Make sure to be accurate and provide supporting documentation if needed.

6. If multiple items or claims are being submitted, use section A, B, C, etc., to list and describe each item or claim individually. Include all relevant details like quantities, descriptions, and monetary values.

7. In section D, briefly explain the nature of the debt or claim being made. Be concise but provide enough information for the authorities to understand the issue.

8. Optionally, attach any supporting documents that are relevant to the claim. These could include invoices, receipts, contracts, or any other evidence that will strengthen the case.

9. Review the completed form thoroughly to ensure all information is accurate and complete. Check for any errors or missing details.

10. Once reviewed, sign and date the form in the respective fields provided at the bottom.

11. Submit the filled-out SF 1164 to the appropriate agency or office as instructed by the specific filing requirements, which may include mailing the form or submitting it electronically.

Remember, the instructions provided here are general guidelines, and it's crucial to review the specific requirements and instructions for filing SF 1164 according to the agency or office you are dealing with.

What is the purpose of sf 1164?

SF 1164 is a form used by federal civilian employees to document their work hours and leave taken. Its purpose is to accurately record and report time worked, leave taken, overtime hours, and any other type of absences from work. This form helps to ensure accurate payment of wages and benefits, as well as maintaining proper records of employee work hours and leave balances.

What information must be reported on sf 1164?

The SF 1164 form, also known as the Claim for Reimbursement for Expenditures on Official Business, requires specific information to be reported. The information includes:

1. Claimant Information: Name, mailing address, telephone number, social security number, and agency/department.

2. Claim Period: Start and end dates for the period during which expenses were incurred.

3. Travel Authorization: If applicable, include the authorization number, date, and any special instructions.

4. Expenses: Detailed listing of expenses incurred, including the type of expense (e.g., lodging, meals, transportation), the date, a description of the expense, the amount spent, and any supporting documentation such as receipts.

5. Official Business Purpose: The specific purpose of the official business or travel.

6. Certifications: The claimant must sign and certify that the information provided is accurate and complete, that the expenses claimed are reasonable and necessary, and that the expenses have not been reimbursed from any other source.

7. Approvals: The form requires certification and approval from an authorized approving official within the claimant's agency/department.

It's important to note that the exact information required may vary based on the specific agency's guidelines and policies, so it is advisable to consult the agency's instructions or guidelines when filling out the SF 1164 form.

What is the penalty for the late filing of sf 1164?

The penalty for the late filing of SF 1164 depends on the specific circumstances and policies of the organization or agency in question. In general, late filings may result in delayed reimbursement or payment, potential deductions or penalties, and possible negative impact on future funding requests or approvals. It is advisable to consult the relevant guidelines or authorities, such as the agency's regulations or financial management policies, to determine the specific penalties for late filing of SF 1164 in your particular situation.

How do I make changes in of 1164 fillable?

With pdfFiller, the editing process is straightforward. Open your of1164 form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit optional form 1164 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing sf 1164 fillable form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my sf 1164 fillable pdf in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your fillable sf 1164 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your of 1164 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Optional Form 1164 is not the form you're looking for?Search for another form here.

Keywords relevant to blankfil 1164 form

Related to fillable sf 1164 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.